Subrogation is a legal right held by insurance companies to pursue a third party responsible for causing an insurance loss to the insured, allowing the insurer to recover the amount paid for the claim.

Subrogation refers to the act of one party standing in the place of another party. In the context of business insurance, it defines the rights of the insurance company both before and after it has paid claims made against a policy.

Your insurance policy contains specific subrogation provisions that outline both your insurer’s rights to pursue recovery and your obligation to cooperate with these efforts, including not taking actions that would impair the insurer’s subrogation rights.

When an insurance carrier pursues a third party for damages, it is said to “step into the shoes of the policyholder.” This means the carrier assumes the same rights and legal standing as the policyholder when seeking compensation for losses.

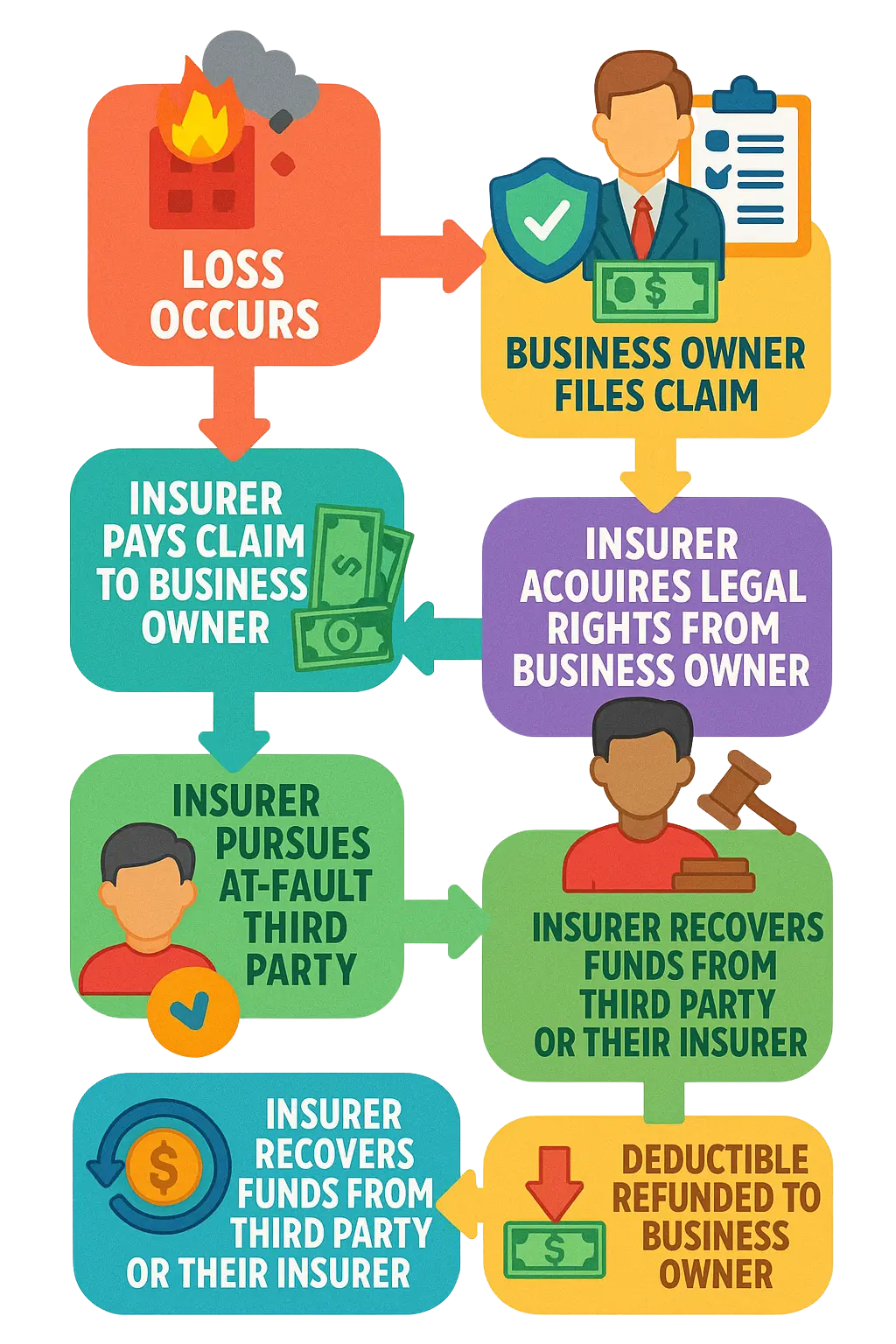

The subrogation process typically involves three key parties: the insured (your business), the insurer (your insurance company), and the third party responsible for the damages. In most cases, your insurance company first pays your claim directly, handling your immediate needs.

Once payment is made, the insurer then seeks reimbursement from the at-fault party or their insurance company. This behind-the-scenes process allows business owners to receive prompt payments without waiting for lengthy liability determinations.

For business owners, subrogation directly impacts how quickly claims are settled and whether deductibles might be recovered. Your insurance policy will include a section on subrogation that explains your provider’s legal right to use this technique in certain scenarios.

The right to subrogation applies across various types of business insurance, including commercial auto, property, workers’ compensation, and liability policies.

Business owners should also be aware of waiver of subrogation provisions, which might appear in contracts with clients or business partners. Waivers prevent your insurance company from pursuing recovery against the specified parties, even if they’re partially at fault.

Insurers typically charge an additional premium for such waivers because they increase the insurer’s financial risk by limiting their recovery options.

Subrogation Examples in Practice

Example 1: Commercial Property Damage

A restaurant owner experiences significant water damage when pipes installed by a plumbing contractor burst six months after installation. The restaurant must close for repairs, resulting in property damage and business interruption losses totaling $75,000.

The owner files a claim with their business insurance company, which promptly pays the claim (minus the $1,000 deductible) so repairs can begin immediately.

Behind the scenes, the insurance company investigates, determines the plumber used defective materials, . and pursues a subrogation claim against the plumbing contractor’s liability insurance.

After successful negotiations, the plumber’s insurance agrees to pay the full $75,000.

The restaurant owner’s insurance company keeps $74,000 (the amount they paid on the claim) and returns the $1,000 deductible to the restaurant owner.

This subrogation process benefits the restaurant owner by providing quick claim payment and eventual deductible recovery, all without having to personally engage in legal action against the plumber.

Example 2: Workers’ Compensation Case

A delivery driver for a small wholesale business is seriously injured when a shelf collapses at a client’s warehouse during a delivery. The driver requires surgery and misses three months of work.

The wholesale business files a workers’ compensation claim, and their insurer pays $45,000 for medical expenses and lost wages.

The workers’ compensation insurer investigates and discovers the warehouse shelving was improperly installed by a third-party contractor.

Through subrogation, the insurer pursues the shelving contractor’s liability insurance for the $45,000 it paid on the claim.

This recovery helps keep the wholesale business’s future workers’ compensation premiums from rising due to the claim, as the loss is ultimately attributed to the negligent third party.

In this case, subrogation protects the small business from bearing the financial consequences of another party’s negligence.

The Benefits and Challenges Associated With Subrogation

Subrogation offers several important benefits for businesses and insurers alike.

For business owners, the most immediate advantage is prompt claim payment without waiting for fault determination between multiple parties.

If successful, subrogation can also result in the return of deductibles paid during the claims process, putting money back in your business account.

Claims settled through subrogation may not ultimately count against your loss experience or trigger premium increases, because the ultimate financial responsibility shifts to the at-fault party. While successful subrogation may help minimize the impact on future premiums, the initial claim is still recorded in your loss history and could affect rates until recovery is complete.

For insurance companies, subrogation recoveries can be a significant revenue stream, especially during weak financial markets, and enable them to offer more competitive premiums.

The subrogation process can be lengthy, sometimes taking months or even years to resolve, leaving uncertainty about deductible recovery.

Subrogation rights vary significantly across states, with some jurisdictions enacting anti-subrogation legislation that limits recovery abilities.

When clients or partners request waivers of subrogation in contracts, businesses face higher premium costs to offset the insurer’s increased risk.

Successful recovery depends on the at-fault party having adequate insurance or assets, and in cases where they don’t, full reimbursement may never materialize despite valid subrogation claims.

What Business Owners Should Know

Business owners should recognize subrogation as a crucial part of their insurance protection. Good communication and thorough record-keeping are your best tools for ensuring a smooth subrogation process and maximizing your business’s financial protection.

- When a loss occurs, document everything—take photos, keep receipts, and save correspondence.

- Promptly notify your insurer of the incident and cooperate fully with their investigation.

- Preserve any physical evidence and avoid making repairs or discarding damaged items until your insurer gives the green light.

- If you receive a subrogation notice or demand from another insurer, review it carefully and consult your own insurer or legal counsel before responding.

- Never admit fault or agree to settlements without guidance.

- If your business is asked to sign a waiver of subrogation in a contract, discuss the implications with your insurance agent or attorney, as it could affect your coverage or premiums.

Did You Know?

While most business owners think of subrogation as a modern insurance practice, it actually has deep historical roots in ancient Roman law under the concept of “subrogatio.”

The modern subrogation industry has evolved dramatically in recent decades, with specialized recovery units becoming increasingly sophisticated.

According to benchmark studies, recovery rates vary significantly by claim type, with standard carriers recovering up to 27% for paid collision claims and non-standard carriers recovering approximately 14.5% for similar claims, representing a significant increase since the initial benchmarks established in the 1990s.

Many large insurers now have dedicated subrogation departments that recover millions annually, using advanced analytics and specialized legal strategies that transform what was once considered just an administrative function into a major profit center.

Many jurisdictions follow the ‘made whole doctrine,’ which requires that policyholders be fully compensated for their losses, including any deductibles and uncovered damages, before insurers can retain subrogation recoveries.

Sources and further reading:

Subrogation in Insurance: What it Is and Why It’s Important

What Is Subrogation In Insurance? | Ask biBerk

What Does Subrogation Mean in Business Insurance? – Embroker

What Is Subrogation in Business Insurance? – Insureon

What Is Subrogation in Insurance? | Progressive

What is a waiver of subrogation? – The Zebra

Subrogation: What Is It and Why Is It Important? | Allstate

Money machine: subrogation strategy is evolving in the US

Subrogation Claims – Maryland Personal Injury Lawyers

Westfield Recovers Millions with Improved Subrogation Process

Property Case Study: Subrogation Example – MJ Sorority

Subrogation Case Study | HM&C Law Offices – Hooks Meng Clement